Investments

The Danish National Research Foundation (DNRF) was established in 1991 with a start-up capital of 2 billion DKK. Since then, the foundation received a 3 billion DKK capital injection from the government in 2009 and an additional 3 billion DKK in 2015. In 2019, the foundation also received 177.4 million DKK, with the purpose of establishing a few special research centers, the so-called Pioneer Centers, in collaboration with private foundations.

Both the capital and the return will be used to finance excellent research at an international level. The current capital is expected to support activities until the end of 2036. The Center of Excellence funding instrument can run up to ten years (6 years + 4 years), which means that most of the capital will be disposed of in 2026, ten years before the foundation’s expected expiration in 2036.

Capital

The capital is invested across different asset classes and countries. When investing, the foundation strives to ensure safety, maintenance of the capital’s real value, as well as the best possible return. The current strategic asset allocation constitutes 62.5% to various bonds and 37.5% to global equities.

The foundation’s strategic asset allocation

The strategic portfolio consists of the following asset types:

- 37.5% Global Equities

- 32% Danish nominal bonds

- 11% Global inflation-linked bonds

- 10% Investment grade bonds

- 9.5% High-yield bonds

The foundation is subject to several placement rules, including a requirement to use external portfolio managers, per Executive Order No. 325 of March 29, 2016, for the financial management of Danish National Research Foundation funds. The foundation uses EU tenders when searching for new external portfolio managers.

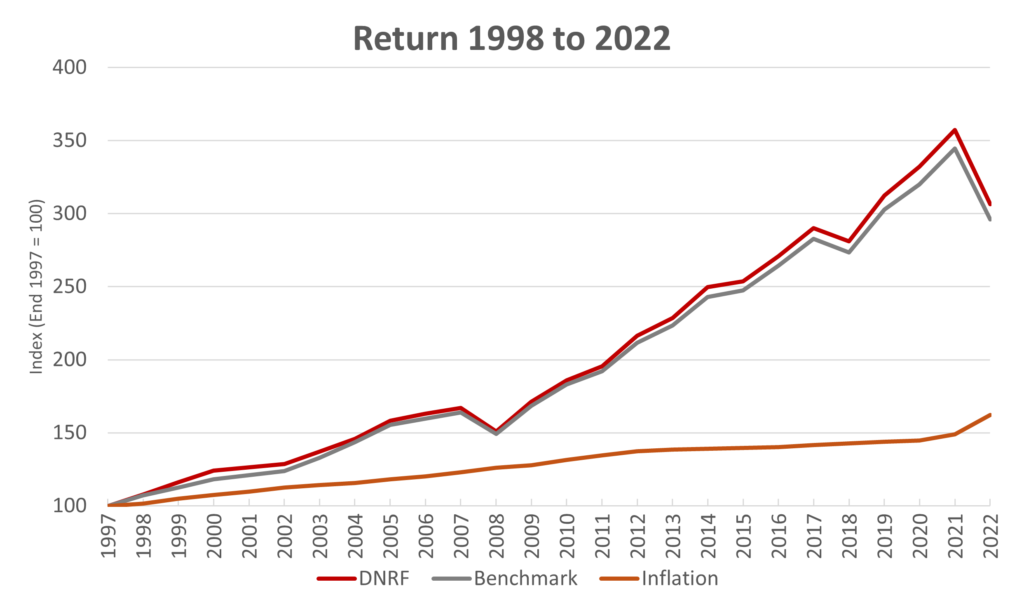

Historical return

Risk management

The foundation uses Conditional Value at Risk (CVaR) when calculating the portfolio’s risk which is compared with the foundation’s net capital. In addition, the current portfolio’s return during different historical events that have played out in the real world is used as part of the risk management to illustrate the portfolio’s risk. The risk report to the board contains the portfolio’s CVaR, the return in the historical events and the DNRF’s bond portfolio’s option adjusted duration.

Responsible investment policy

The Danish National Research Foundation’s responsible investment policy and the goal of acting as a responsible investor are an integral part of the foundation’s overall investment principles and strategy.

The DNRF acts as a responsible investor by investing in companies that live up to common internationally accepted principles and norms for treating environmental, social, and governance (ESG) issues and by not investing in companies involved in the production of controversial weapons (cluster munition, anti-personnel mines, biological weapons, and chemical weapons).

Furthermore, it is the DNRF’s goal that the foundation’s investments shall follow the Paris Agreement’s goal to limit global warming to well below 2 degrees Celsius, preferably to 1.5 degrees Celsius, compared to pre-industrial levels. This will be done by halving the emissions of global greenhouse gas emissions by 2030, and by 2050 that greenhouse gases have a neutral climate impact.

It is a requirement that the foundation’s portfolio managers as a minimum live up to the DNRF’s responsible investment policy and guidelines and that all portfolio managers are signatories to the UN’s PRI.

Guidelines for equities and credit bonds

The following is relevant for the foundation’s investments in equities and corporate bonds. The guidelines are based on well-recognized principles, guidelines, conventions, treaties and international ESG standards.

When investing, portfolio managers must:

- strive to live up to the United Nations Global Compact principles and/or OECD Guidelines for Multinational Enterprises;

- not invest in companies that violate broadly accepted international weapons-related conventions (cluster munition, anti-personnel mines, biological weapons, and chemical weapons);

- not invest in producers of nuclear weapons in violation of the treaty on Non-Proliferation of Nuclear Weapons;

- exclude tobacco producers;

- strive to live up to the ILO conventions on labor rights; and

- not invest in companies involved in the extraction of thermal coal or oil and gas extraction from tar sand or power generation from thermal coal, however allowing a:

- maximum 5% of revenue from extraction of thermal coal or tar sand.

- maximum 30% of revenue from power generation from thermal coal.

If the company has a credible and serious plan for divesting the thermal coal and/or tar sand business or for applying the goals of the Paris Agreement, the company may be included in the portfolio, even if the company does not comply with the limits above.

The mutual funds may have other criteria than those stated above when investing.

Implementation

The regulatory framework states that the DNRF shall use external portfolio managers for all of its investments. The external portfolio managers are also responsible for implementing the responsible investment policy. Implementing the responsible investment policy may therefore differ between the portfolios/mandates.

The foundation can invest in mutual funds. However, it is not likely that a minority investor (such as the DNRF) in a mutual fund can determine the mutual fund’s policy for responsible investments. The consequence is that these portfolios/mandates may not have exactly the same policy for responsible investments as stated above.

When the foundation chooses a mutual fund, the portfolio manager’s/mutual fund’s policy for responsible investments is an important selection criterion in the overall assessment of the manager of the mutual fund. Mutual funds must at least comply with the most important parts of the DNRF’s policy for responsible investments (principles, conventions, treaties, and the Paris Agreement) at the time they are selected.

The DNRF’s managers of equities and credit bond portfolios screen the portfolios on a regular basis to identify companies that continuously violate the above-mentioned principles and conventions.

On this basis and on the basis of engagement with the companies, the portfolio manager decides which companies should be excluded based on the agreed responsible investment policy. Therefore, the exclusion lists may vary from portfolio to portfolio.

Engagement

Engagement is a part of being a responsible investor. Therefore, the foundation’s external portfolio managers

- should have a dialog with/engage with companies that do not live up to the ESG policy; and

- should exercise their voting rights on important issues.

The foundation’s portfolio managers engage with companies in which they have invested on an ongoing basis, for example, by having a dialog with companies about the relevant issues. The engagement is based on the responsible investment policy applied to the mandate.

The DNRF’s goal is to have as high a share of exercising voting rights as possible. The portfolio managers monitor the items in the general meetings on an ongoing basis and use their voting rights on most of the items.

Government bonds

When investing in government bonds, the foundation only invests in government bonds issued by countries that act in accordance with internationally recognized principles of good governance and human rights and where the country or the key individuals in the country are not subject to UN or EU financial sanctions.

Reporting

To monitor progress towards the goal of achieving climate neutrality by 2050, DNRF will report on CO2 emissions from the portfolio. Initially, the report will focus on the CO2 emissions from the equity portfolio, the figures for the emerging markets are not included. Two key figures are reported as described below. Efforts are being made to have the figures displayed for a larger part of the portfolio.

The climate footprint of the equity portfolio

The equity portfolio’s climate footprint is calculated using two key figures: CO2 footprint and carbon intensity, which are shown below.

The emission figures are presented in the tables below. The reported figures include scope 1 and 2 emissions. It is worth noting that the key figures for the emission are associated with uncertainty and must, therefore, be interpreted with caution. Work is underway to obtain reliable figures for Scope 3 emissions.

Scope 1 emissions: Include direct greenhouse gas emissions originating directly from an organization’s or company’s own sources or activities. This can encompass emissions from factories, facilities, vehicles, and other direct combustion of fossil fuels.

Scope 2 emissions: Encompass greenhouse gas emissions arising from the external production of energy consumed by the organization. These emissions come e.g. from the external production of electricity, steam, heat, or cooling used by the company. For instance, these emissions could stem from coal-, gas-, or oil-fired power plants that produce electricity utilized by the company.

Carbon footprint.

The carbon footprint is calculated using the method where the companies’ CO2e emission is set in relation to the company’s value, the so-called EVIC (Enterprise Value Including Cash).

|

Carbon emissions/EVIC |

End 2022 |

End 2023 |

| DNRF’s global equity portfolio |

47.8 |

40.1 |

| Benchmark (MSCI World) |

49.1 |

44.8 |

CO2e stands for “carbon dioxide equivalents” and is a unit used to measure and compare the impact of different greenhouse gases on climate change. As different greenhouse gases have varying effects on the greenhouse effect, they are converted into a unit representing the amount of carbon dioxide (CO2) that would have the same global warming effect.

Weighted average carbon intensity.

The carbon intensity is calculated by setting the companies’ CO2e emission in relation to their revenue. To derive an overall figure for the carbon intensity of the portfolio, the individual companies’ carbon intensity is weighted according to their respective weight in both the portfolio and the benchmark (see the table below). The carbon intensity method can be used to compare portfolios and see the development over time.

| Weighted Average Carbon Intensity (t CO2e/M EUR sales) |

End 2022 |

End 2023 |

| DNRFs global equity portfolio |

113.9 |

89.7 |

| Benchmark (MSCI World) |

120.1 |

111.5 |

Investment committee

In 2018 the board decided to establish an investment committee. The committee’s job is to give the board recommendations about the investment strategy, risk management, portfolio managers, responsible investment policy, and long-term forecast for the foundation’s expected disbursements.

The members of the investment committee are:

- CIO Per Skovsted (Chair)

- Professor Peter Løchte Jørgensen

- Senior Director Tine Choi Danielsen

Per Skovsted (born in 1958) has a Master of Science (M.Sc.) in Business Administration from the Copenhagen Business School. Skovsted is a member of the board of Investeringsforeningen Nordea Invest, Stryhns Familieselskab A/S, True Content Entertainment A/S, VKR Holding A/S, Wide Invest ApS and Spinnewco ApS. Per is also a member of the investment committee for Helsefonden

Skovsted joined the investment comittee on July 1, 2020 and is the chair of the investment comittee.

Peter Løchte Jørgensen (born in 1967) has a master of science (M.Sc.) in Mathematics-Economics and a Ph.D. in Finance. He is a professor of finance at the Institute of Economics at Aarhus University. Jørgensen is also chair of the board of AUFF Invest P/S and member of the board of AUFF Holding P/S, AUFF Komplementar ApS., Asset Advisor Fondsmæglerselskab A/S, Investeringsforeningen Selected Investments, Konsul Tømmerhandler af Horsens, Harald Blegvad Jørgensens familielegat. He is also the chair of the Carlsberg Foundation’s investment committee.

Jørgensen has been a member of the Danish National Research Foundation’s investment committee since the committee was established in April 2018.

Tine Choi Danielsen (born 1973) holds an master of science (M.Sc.) in Economics from Aarhus University. She is Head of Investment Strategy & Analysis at PFA Pension, where she has been employed since 2019. Before Tine joined PFA, she worked for several major Nordic banks, most recently as Chief Strategist at Danske Bank Wealth Management.

Tine Choi Danielsen joined the investment comittee in december 2022.